With the Options module configured, Options related information can be found in the Market data and Mark to Market screens.

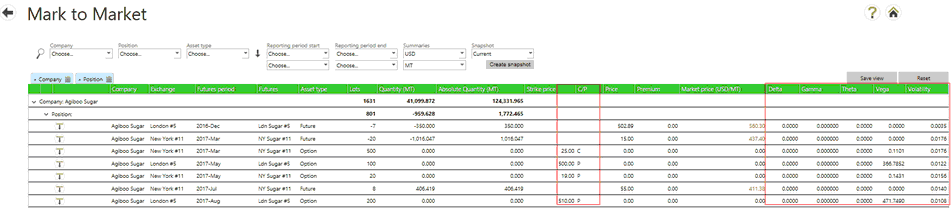

Mark to Market Screen

Data entered into the Options module impacts data in the Mark to Market screen and Mark to Market details screen columns:

| • | C/P - C or P will appear depending on the Option contract type. A call option gives the right to buy such futures, and a put option the right to sell such futures. |

| • | Greeks (Delta, Gamma, Theta and Vega) - analytical metrics for options and the relation with their underlying futures. |

| o | For example, the Delta indicates how much the Premium of an option will change for every USD of change in the price of the underlying futures. |

| o | Agiblocks Greeks values are calculated using the Black model formulas. |

| • | Lots - The number of options lots indicates two things: |

| i. | The absolute number of lots indicates how many futures lots can be bought or sold. |

| ii. | The sign of the number of lots indicates if either lots were bought (positive) or sold (negative). |

| • | Market price - the market price of an option is calculated using the Black model formulas. |

| • | Price - the price for which the option itself was bought or sold. |

| o | Note: this is sometimes referred to as an option premium in trading literature. However, this should not be confused with what Agiblocks calls a Premium for physical contracts. |

| • | Strike price - the price at which the owner of the option can buy or sell the futures. |

| • | Volatility - a statistical metric for the amount of price changes in any asset including futures and options. |

| o | Typically high volatility makes options more expensive (meaning their Price goes up). |

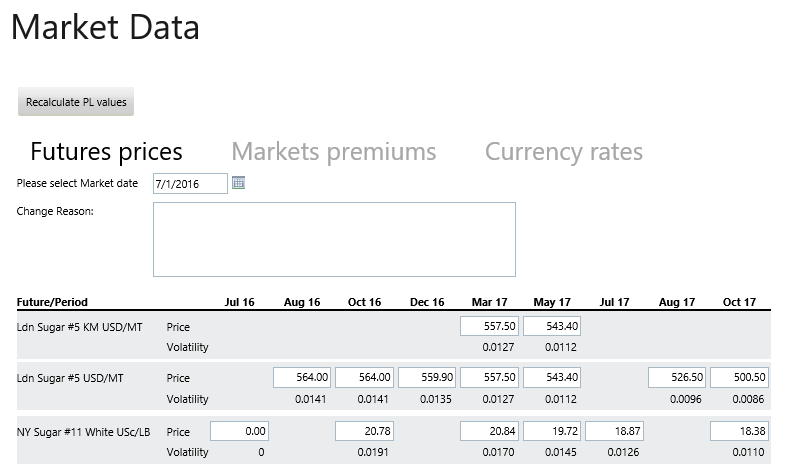

Market Data Screen

A volatility value will appear for each Futures period price. These values appear in a row called Volatility under the market price for each period.