The following are calculations used in volatility and Black model values.

Volatility

DailyVolatility = STDDEV(LogReturn[0 .. 19])

Where LogReturn[i] = LN(Price[i]/Price[i+1])

Where Price[0] = today’s price, Price[1] = yesterday’s price, Price[2] the day before that

Yearvolatility = DailyVolatility * SQRT(DaysPerYear)

Black Model

The formula for the Black model for valuation of options on futures can be summarized as:

1. Inputs:

| • | U = Price of the underlying future instrument |

| • | E = Strike price = the price at which the option give the right to buy (call options) or sell (put options) |

| • | t = time to expiration in years (compare currentDate to optionExpirationDate |

| • | r = risk free interest rate = system parameter or passed in by user and passed on to constructor |

| • | v = Volatility, as calculated above |

| • | Function N'( x ) to calculate normal distribution density values |

| • | Function N( x ) to calculate cumulative normal distribution values |

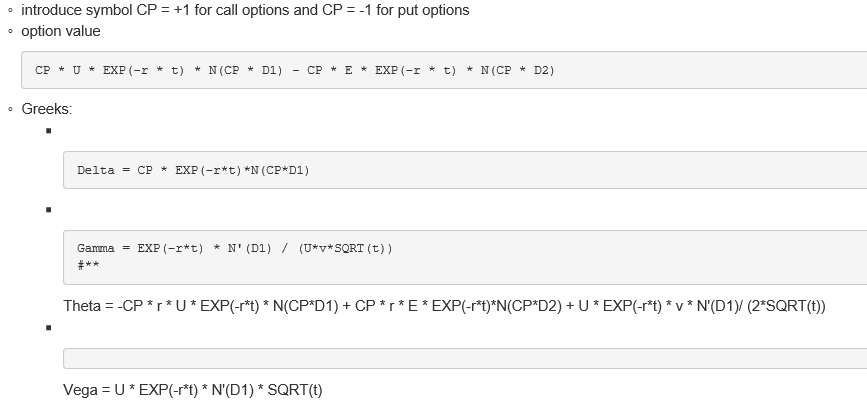

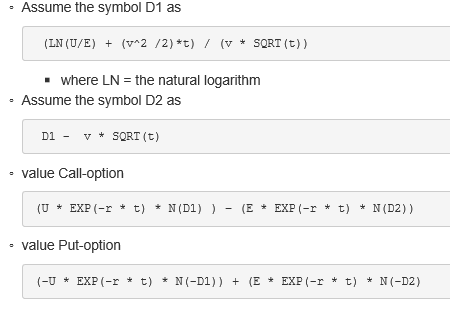

2. Formulas (source: Natenberg 1994, Option Volatility & Pricing, appendix A)

3. Rephrased formulas: