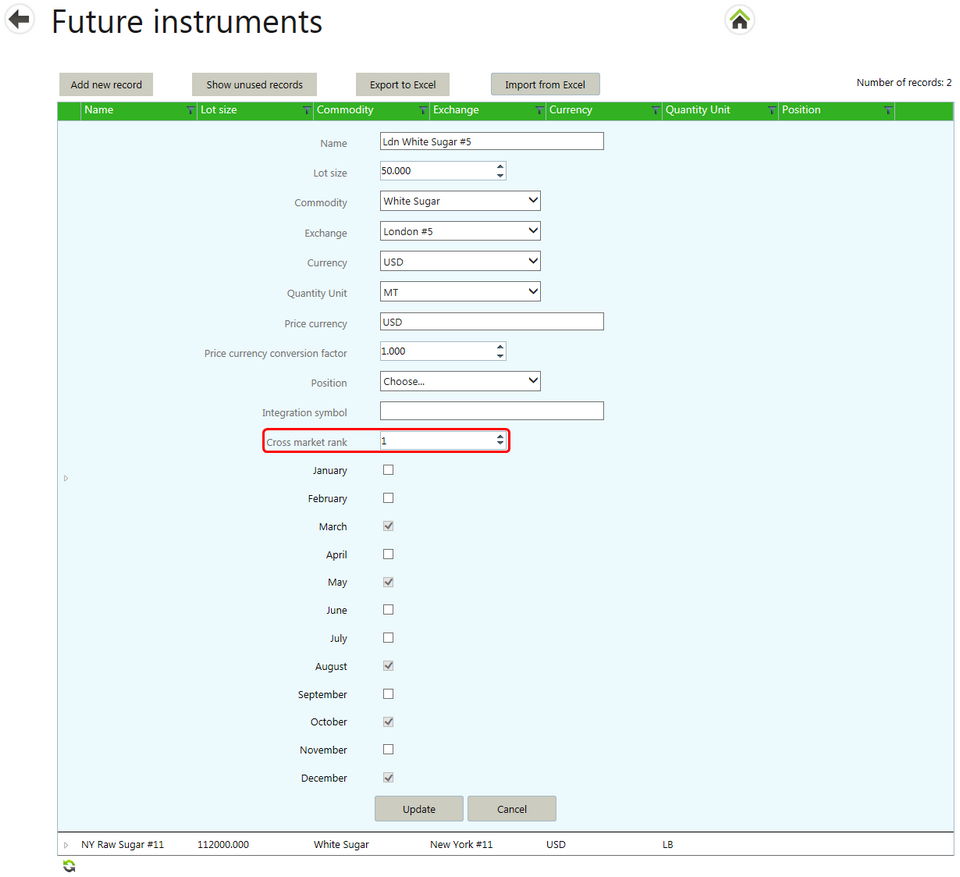

A Master data administrator can enable cross-market rolling by adding a unique "cross-market rank". This is done by editing a future instrument to indicate the order in which the instruments are used when rolling a Position to a different Futures market. This ordering is necessary to calculate the price:

| • | For example, by convention, the cross-market rolling price for sugar is defined as the Sugar #5 price minus the Sugar #11 price. As it happens, that will always be positive. You can manage this by giving the Sugar #5 a higher cross-market rank (ranked nr. 1) than for Sugar #11 (ranked nr. 2). |

| • | If no rank is specified, then that instrument cannot be used in cross-market rolling. |