Agiblocks allows a trader to move physical contracts between positions valued against different futures markets. A further extension of this functionality allows this to be done when those future markets are quoted in different currencies. This is especially interesting for Cocoa traders who need to deal with the fact that the London Cocoa futures are quoted in GBP while the New York Cocoa futures are quoted in USD. It is a common scenario to buy Cocoa against the London market and sell it against the New York market. Agiblocks will record the prices of both futures in their own currencies, as well as the currency rate. This information is then used to recalculate the basis of the contract in the new currency. Like for markets with the same currency it will also show a Position Rolling Requirement to which the traded futures from both exchanges can then be allocated in pairs.

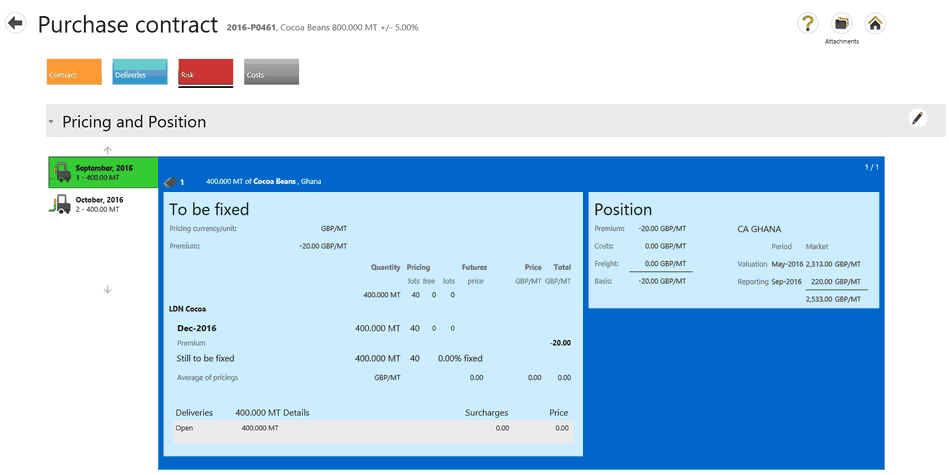

Cross Market Rolling on the Contract Risk Tab

| 1. | Purchase cocoa from Ghana, in a GBP based position. |

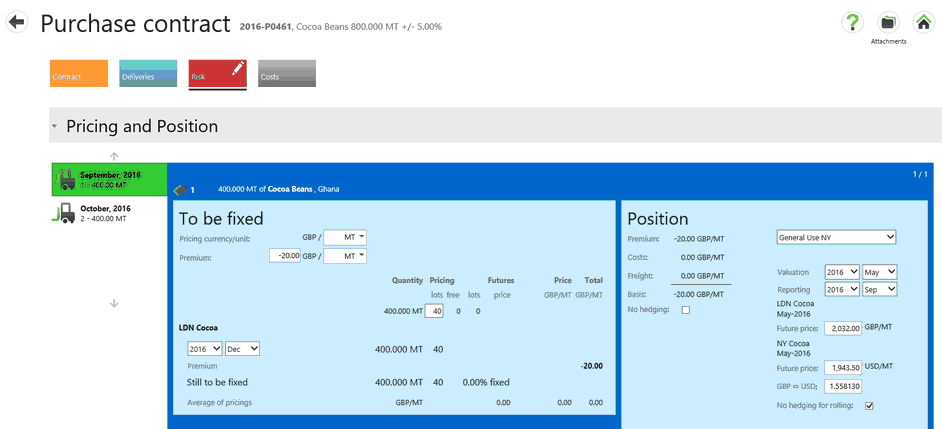

| 2. | Roll the position to the New York futures market in USD. |

| a. | Enter price of London futures to buy. |

| b. | Enter price of NY futures to sell. |

| c. | Enter rate between USD and GBP. |

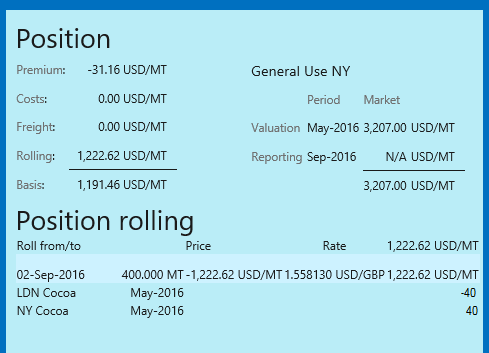

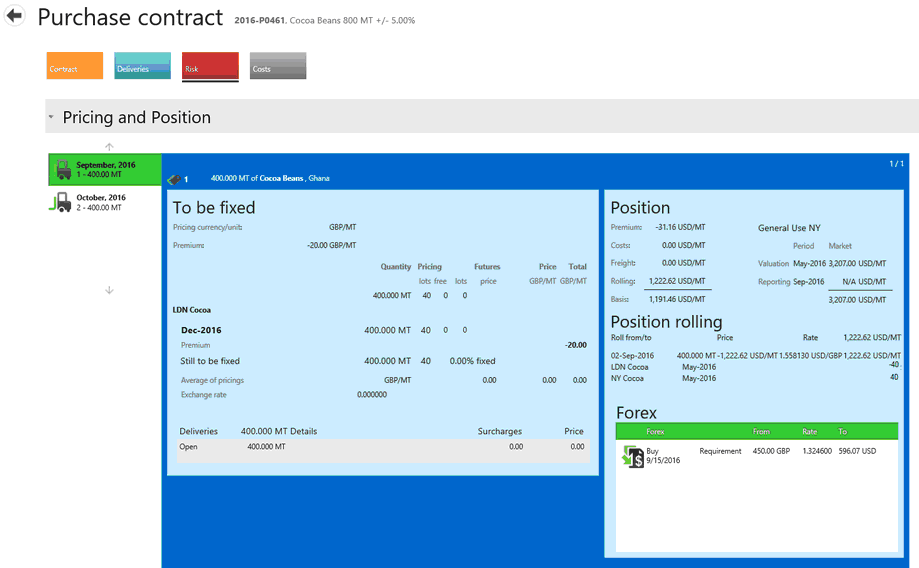

| 3. | After saving you will see the rolling results calculated and included in the Basis calculation. |

In the Hedge allocation screen you will see a position rolling to allocate the traded London and NY futures as pairs.

| 4. | You can also record a Forex requirement for the position. |

In all these cases, Agiblocks records the rate at which this rolling happened and this rate is used to calculate the complete result of such rollings, and include that result in the calculation of the Basis. In the case where properly covering rolling to and from positions that are not valuated by futures is present, Agiblocks will manage creating the corresponding requirements to hedge or un-hedged the contract in the futures market, as well as record the currency rate if the currency changed as well, which is needed to calculate the Basis.

Handling contracts whose price is expressed in a currency that differs from the currency of the position

Agiblocks will require you to record the currency rate between those 2 currencies when entering a new contract. This is used to calculate the Basis.

Example:

You choose a position for a contract that uses GBP.

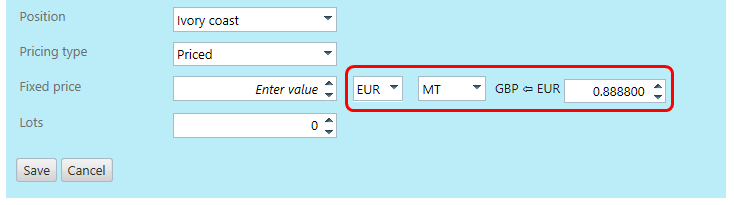

Then the currency is changed to EUR. A rate field now appears:

In this situation, Agiblocks needs to know the rate in order to be able to convert the price to position currency and calculate the Basis.

Note: Agiblocks will still require users to manage their Forex risk by recording Forex Requirements.