Multiple VAT/GST records may be entered for an Internal Company.

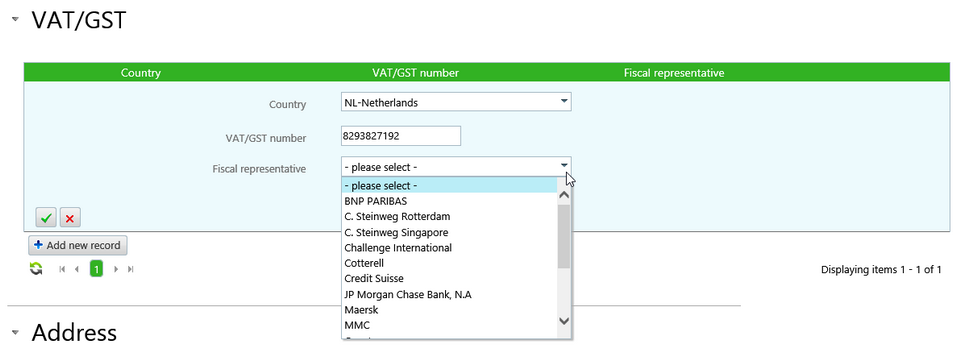

| • | To add a new VAT/GST record, select the Add new record button in the VAT/GST section. An edit box opens. |

| • | Select the Country. |

| • | Enter the VAT / GST number in the next field. |

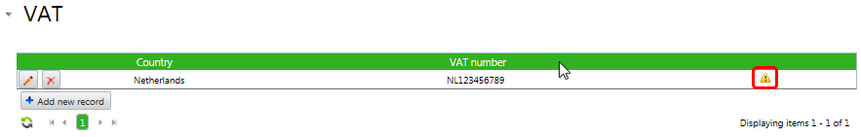

| ▪ | For countries identified as belonging to the European Union in Master data, the VAT number will be automatically validated with the online VIES (VAT Information Exchange System). |

| ▪ | Note: This European Union VAT validation system setting can be switched off to allow manual validation of VAT numbers for EU countries. Please contact Agiblocks Support for assistance. |

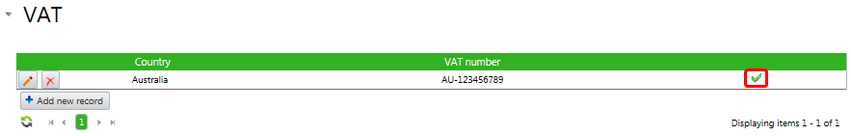

| ▪ | For non-EU countries, a Validated check box is displayed. Checking this box manually validates the VAT/GST number. This box must be ticked to have the VAT/GST number appear in a VAT / GST drop-down list on an invoice. |

| • | Select a fiscal representative from the list of Relations in the drop down list or leave it blank. A fiscal representative is a company or bank that does the VAT declaration or tax processing work for the Internal company. |

| • | Select the green check mark to save the record or the red cross to cancel the operation. |

VAT / GST Number Validation

Validated VAT numbers have a green tick at the end of the line and will appear in drop-down boxes elsewhere in Agiblocks.

Un-validated VAT numbers have a yellow warning at the end of the line and will not appear in drop-down boxes elsewhere in Agiblocks.

| • | Select the Save Company button at the bottom of the Edit internal company screen to commit these changes. |

Notes:

| • | Multiple VAT numbers may be added, but only one per country. |

| • | Please refer to the Master data section on VAT Rates Master data setup and the Invoices section for more information on VAT and Invoices. |