A Master data manager can set VAT or GST rates in Master data.

| • | Select VAT/GST rate from the list of Master data tables under the Trade tab of the Configuration tile, which is under the Settings tab of the Home screen. |

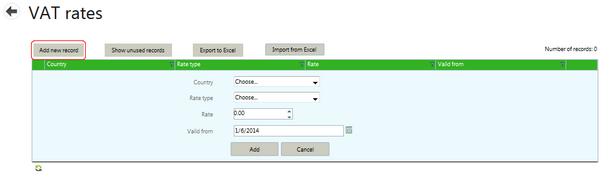

| • | Select the Add new record button. This opens an Edit box for the new record. |

A VAT/GST Rate record needs four values:

Country |

This is the country associated with the VAT Rate. |

||||||||

Rate Type (mandatory) |

There are four available:

|

||||||||

Rate % |

This is the actual VAT % to be applied according to the Rate type. |

||||||||

Valid from |

This is the date from which the VAT rate should be used. |

After filling in the information, select the Add button to save the record. Select Cancel to abandon any changes and return to the VAT Rate list.