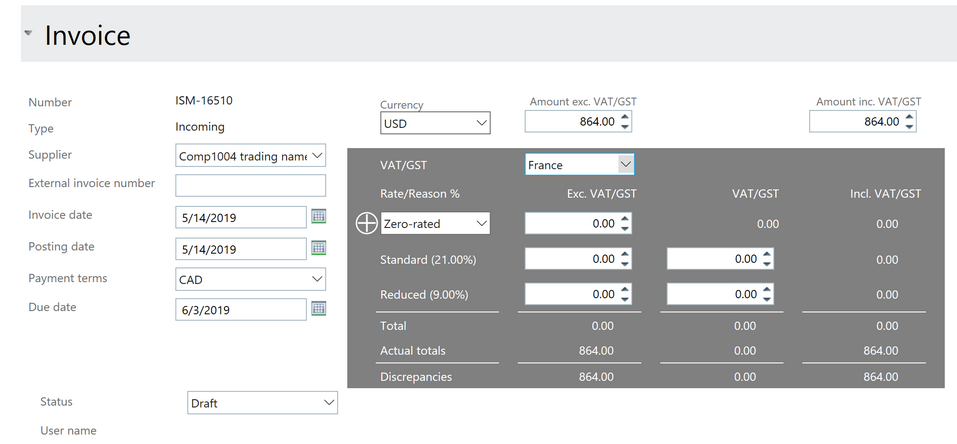

Until now you could only enter the overall VAT amount on the incoming invoice. Along with the changes to make allocation of incoming invoices to cost items more efficient, you can now record complete VAT/GST details on incoming invoices. With the new incoming invoice editor you can:

| • | Declare 1 or more VAT/GST rates and amounts on the invoice. |

| • | On each allocated cost item add indicate which rate applies to that allocation. |

To make it easy to enter, defaults are applied:

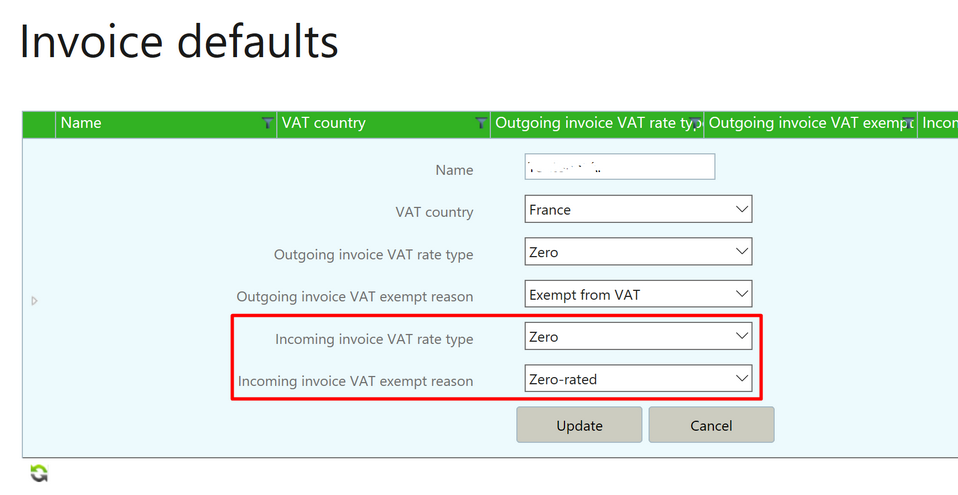

| • | The Invoice defaults for VAT/GST have been extended to allow separate defaults for Incoming invoices. They are used to automatically enter 1 VAT rate. |

| • | The first VAT/GST rate will by default be applied to each allocated cost item. |