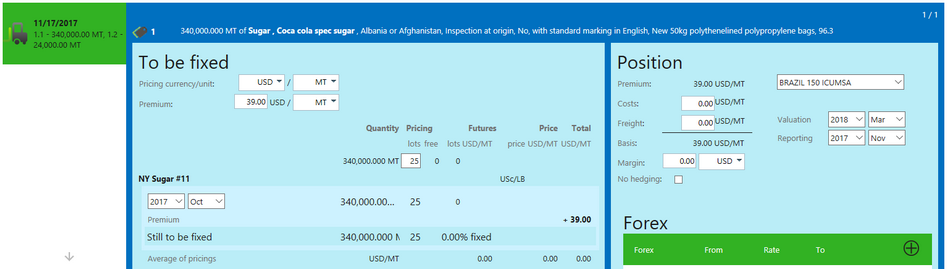

It is possible to roll both the Valuation period and position on a contract’s Risk tab.

| • | Select the Edit button to put the Risk tab into Edit mode. |

| • | Change the Valuation Period. A "Do a rolling:" check box appears under the Reporting fields. |

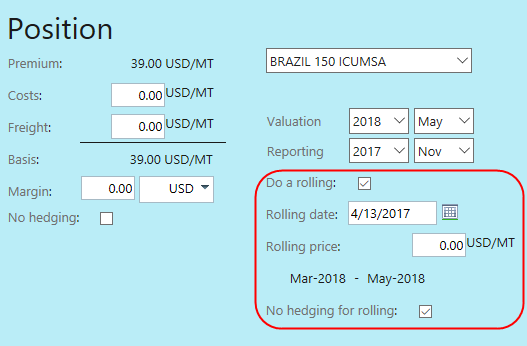

| • | Tick the "Do a rolling" check box. A Rolling price field, a date field to enter a date for rolling and a "No hedging for rolling" check box appear along with a confirmation of the rolling from and rolling to periods. |

| • | The following rules apply to entering a rolling date: |

| 1. | The default value for the date field will be the current date, unless period closure is enforced and the open period is in the past. In this case, the last date of the open period will be used as the default. |

| 2. | The date must not be earlier than the date of existing rollings. |

| 3. | Dates in the future are not allowed. |

| 4. | If period closing is enforced, only dates within the period open for trade may be selected. |

| 5. | The date picker will only show available dates that may be selected. |

| • | Enter a rolling price. |

| • | Tick the "No hedging for rolling" check box if a hedge allocation should not be created for this position roll. |

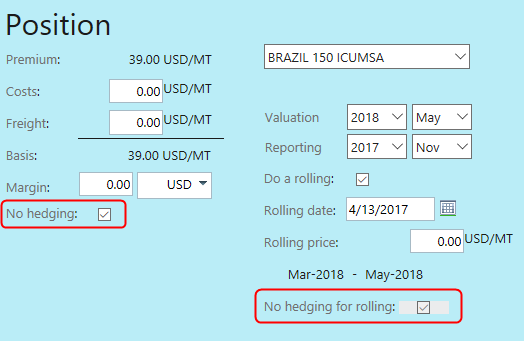

Note: If the “No Hedging” tick box to the left has already been ticked, this automatically ticks the “No Hedging for rolling” tick box and places it in read-only mode as shown below.

| • | Select Save and Close at the bottom of the Risk tab to commit the changes. |

This rolling action can be repeated if necessary to roll again to a future or past period.

Note: Agiblocks only supports rolling when rolling between two positions that have a valuation instrument, otherwise it’s just a position change.