Basis support is additional functionality to help evaluate risk. This is the difference between the cash price and the futures price of a commodity. It allows users to quickly assess the value of their contracts by calculating and displaying the valuation on a common basis, FOB premium.

The calculations are:

| • | For Sales contracts: Premium - Costs - Freight |

| • | For Purchase contracts: Premium + Costs + Freight |

When costs and freight are null then the calculated field is also empty.

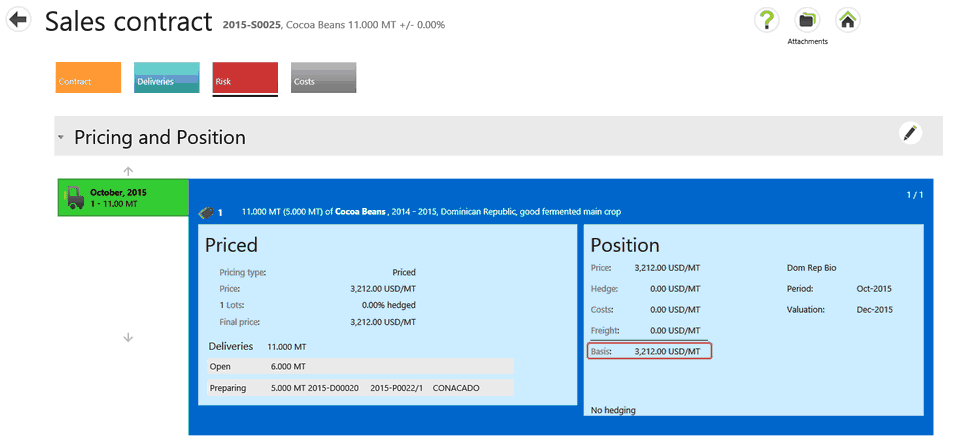

The FOB premium value is shown on the Contract Risk tab if applicable:

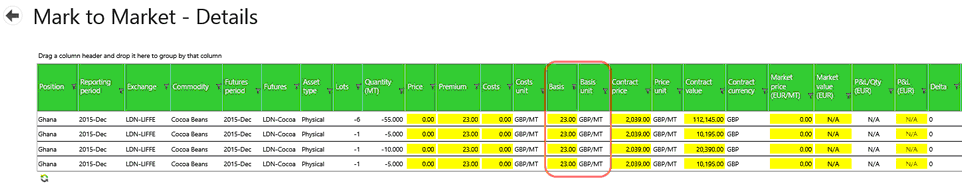

The Basis value will also be shown on the Mark to Market detail screen.

| • | On the first Mark to Market screen, select a line item and select |

| • | This brings up the Mark to Market - Details screen. |

| • | On this screen, you may have to add this specific column, by right clicking-on the green list header line: |

Mark to Market screen showing the Basis and Basis per unit column:

Note: The basis calculation in Mark to Market includes the Position Rolling price. The total displayed on the risk tab is synced to avoid repeating the calculation logic in Mark to Market. Both the P&L and the basis calculations are updated to use the rolling premium. The rolling premium is always in the same currency and quantity unit as the premium. It has the same sign 'logic' as the cost and freight.