Ratio contracts are not treated in Risk related calculations in the same manner as Fixed or To be Fixed contracts:

| ▪ | Ratio contracts do not have the concept of fixing lots. |

| ▪ | Ratio contracts are fixed for the quantity and the lots are a variable factor. |

| ▪ | Ratio contracts are fixed by request of the counterparty and the trader can determine the number of lots to be hedged. |

| ▪ | After this manual pricing the actual fixing and hedge allocation can be done. |

As result of the above:

Hedge Requirements

| • | Ratio contracts are not listed as fixing in the hedge requirements as lots are not fixed, but the quantity is. |

| • | As noted the hedge requirement is listed at the moment the trader decides what is to be hedged. |

Contract Risk Tab

| • | The contract risk tab does NOT show to-be-fixed lots as the fixing as based on the quantity. |

| • | The lots on this screen are to be used as a calculated number of lots based on the current market and to be treated as estimated. |

| • | This means that there are no lots-to-be-fixed for ratio contracts. |

Mark to Market

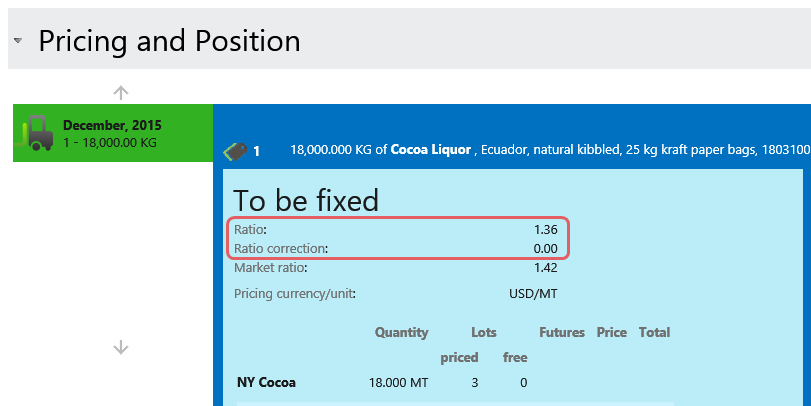

The valuation/calculation is done with the contract Ratio and Ratio correction.

In addition to the number of lots Agiblocks has hedge quantity and hedge lots which are calculated based on the actual market ratio for analysis purpose.

Position

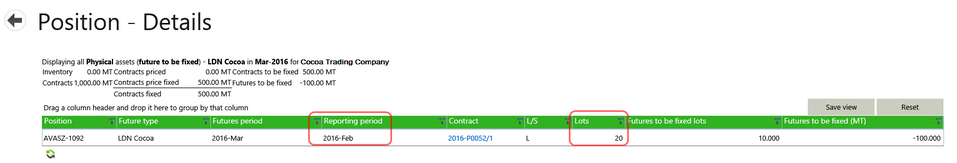

| • | The position summary provides the physical position. |

| • | The Position detail screen can provide the Reporting period and Lots columns as well. |

| • | The to-be-fixed column is only supported for differential trading as this is based on the to-be-fixed lots and as noted the ratio contracts are not fixed on the number of lots but on the quantity. |