Agiblocks rules for pricing allow flexibility. Common pricing information such as Position, Future Instrument, Future Period, Future Year, Settlement and Premiums can be entered per contract delivery line. Which exact fields and information appear depends on the Position and Pricing type selected and how this information has been configured in Master data.

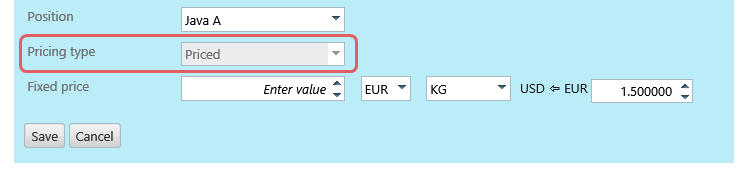

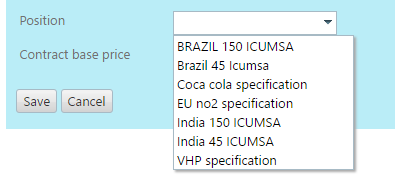

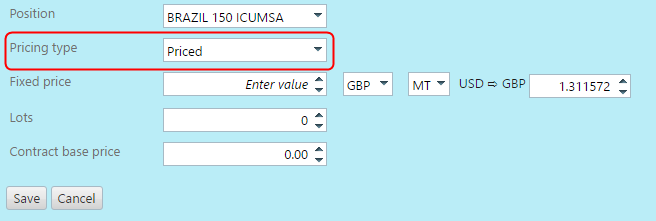

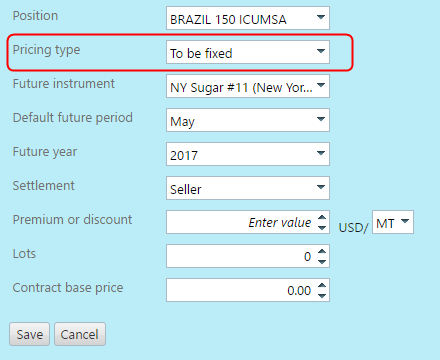

Selecting a Position will bring up the initial options for Pricing terms.

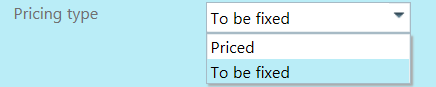

Selecting the Pricing type, Priced or To be fixed, may further configure the fields for entry.

In Agiblocks, a Priced contract specifies buying or selling a commodity for a fixed price. The Fixed price, currency, quantity type, lots and contract base price fields are used for this type of contract delivery line. Changing the currency may result in a currency conversion field appearing.

A To be Fixed contract may have futures assigned to it along with having other pricing rules.

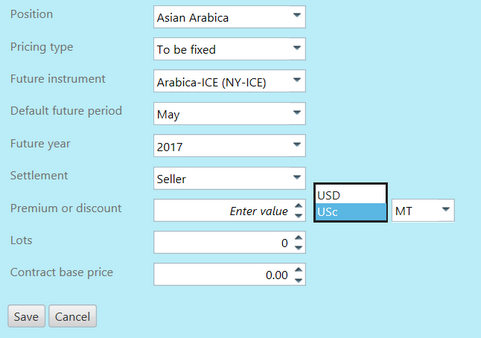

Depending on the Commodity, Futures and Position configuration, the information needed for pricing will vary. For example, if the Commodity selected for a To be Fixed price uses differentials, a premium or discount entry field will appear. Further, a premium value can be entered in a full currency or currency cents, if cents have been enabled for the Position's currency.

Note: After initial entry, the contract type is only editable when there are no futures allocated to one of the associated delivery lines.

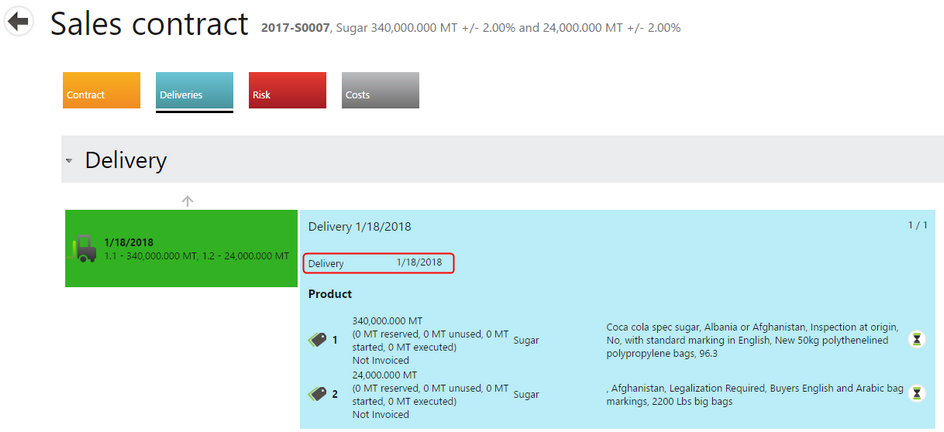

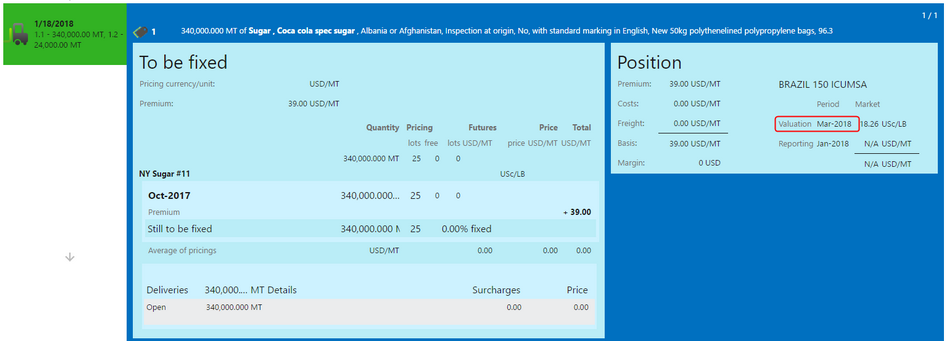

Reporting and valuation period rules for new contract entry

When multiple deliveries are created, all delivery lines are assigned to the Position specified in the contract delivery line, but the reporting and valuation periods are set as explained below.

The Reporting period will be set to the month in which the delivery period falls.

The Valuation period is derived from the configuration of the Futures instrument in the Master data, using the selected reporting period and the futures type used to value the position.

Positions without a valuation instrument

If a company does not use futures, Positions should be set to Physical contracts without a valuation instrument. When entering a contract for a Position without a Valuation instrument (futures), the pricing type drop down field will appear automatically as priced and be read only.