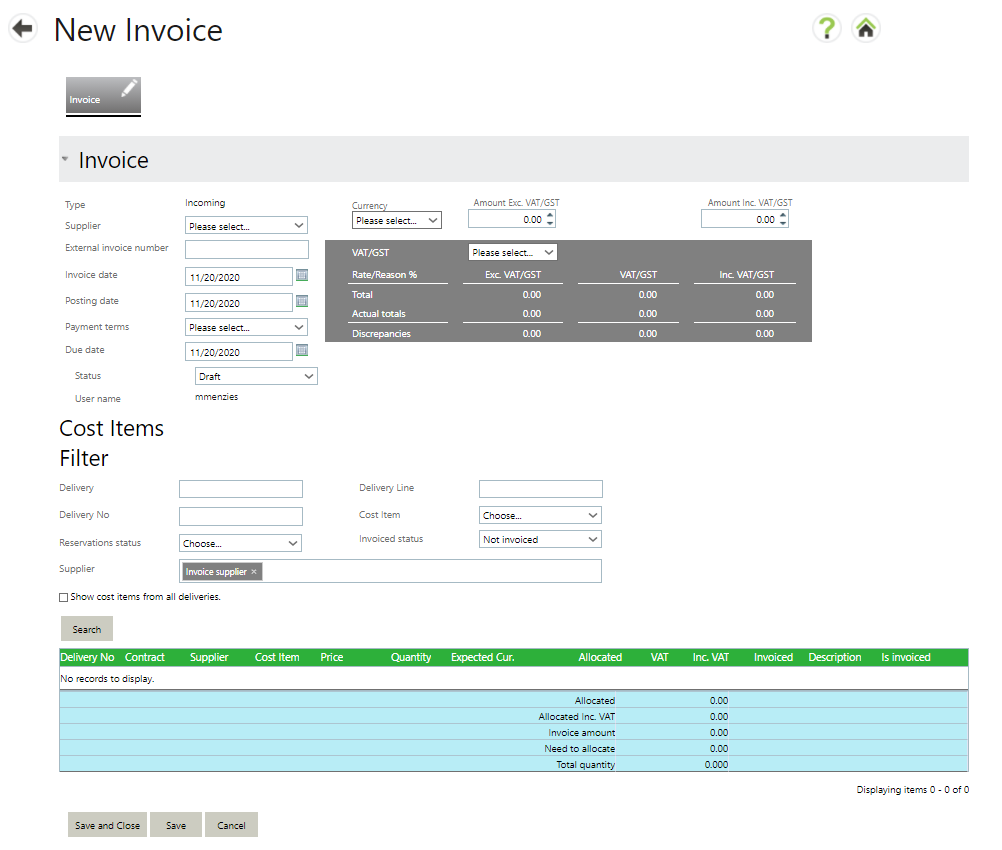

Select the New button at the top right App bar on the screen. A blank invoice screen will appear.

Note: The VAT/GST section may look different depending on how VAT/GST is configured in your Agiblocks system.

Fill in the following Invoice section information:

| • | Supplier - A counterparty or relation to be paid |

| • | External Invoice Number – Invoice number on the document |

| • | Invoice date - Date of the invoice |

| • | Posting date - Posting date for the invoice |

| • | Payment term - The payment terms stated on the invoice |

| • | Due date - Date for the invoice payment |

| • | Status - Invoice status: draft or complete |

| • | User Name - This is prefilled with your Agiblocks user name |

| • | Currency - Invoice currency type |

| • | Amount Exc. VAT - Total amount of the invoice excluding VAT |

| • | Amount Inc. VAT - Total amount of the invoice including any VAT |

VAT/GST Section

If your VAT/GST section has not been configured with a default, selectthe VAT/GST designation for the invoice. This designation is usually per country. You can declare 1 or more VAT/GST rates and amounts on an invoice depending on how your VAT/GST Master data has been configured.

Select Save and Close to save the information and return to the incoming invoices list. Select Save to save the information and continue editing. Select Cancel to discard any information and return to the Incoming invoices screen without saving the invoice.