VAT Rates must be selected by you for each cost item.

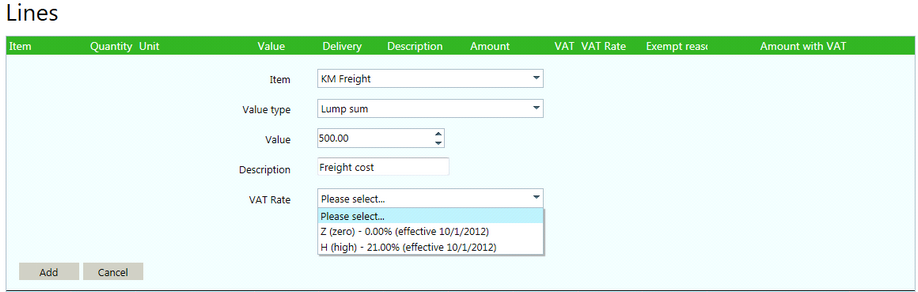

| • | Select the Add new record button in the Lines section of an outgoing charge invoice. |

| • | This opens an edit box to add a new cost line. |

| • | Enter the cost information and select the VAT Rate drop-down list to see the available VAT Rates. |

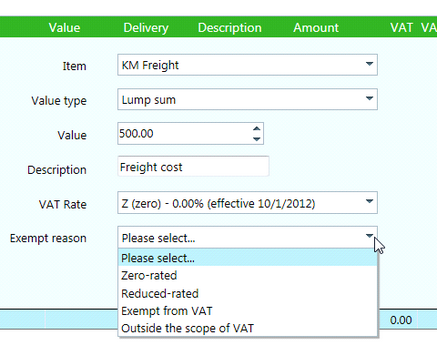

| • | Select a VAT Rate. If a Zero rate is selected, an additional field to fill in a reason will appear. This field is required. |

There are four reasons available to apply for a Zero VAT rate:

Zero-rated |

The cost does not have VAT associated with it. |

Reduced-rated |

The VAT cost is reduced. |

Exempt from VAT |

No VAT need be applied to this type of cost. |

Outside the scope of VAT |

VAT cannot be applied to the cost. |

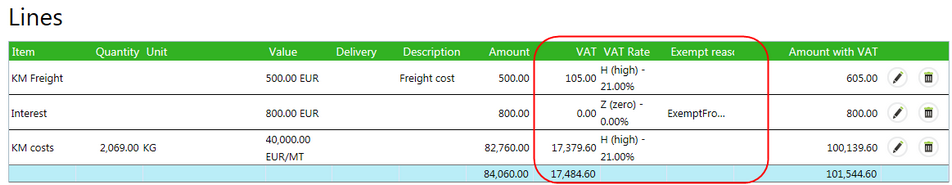

Once all information has been added, select the Add button to add the cost line. The cost item will be added to the invoice and the VAT for that cost item calculated automatically for that cost line.