The Position rolling price is positive or negative depending on the value from subtracting the later date’s price from the earlier date’s price.

Example:

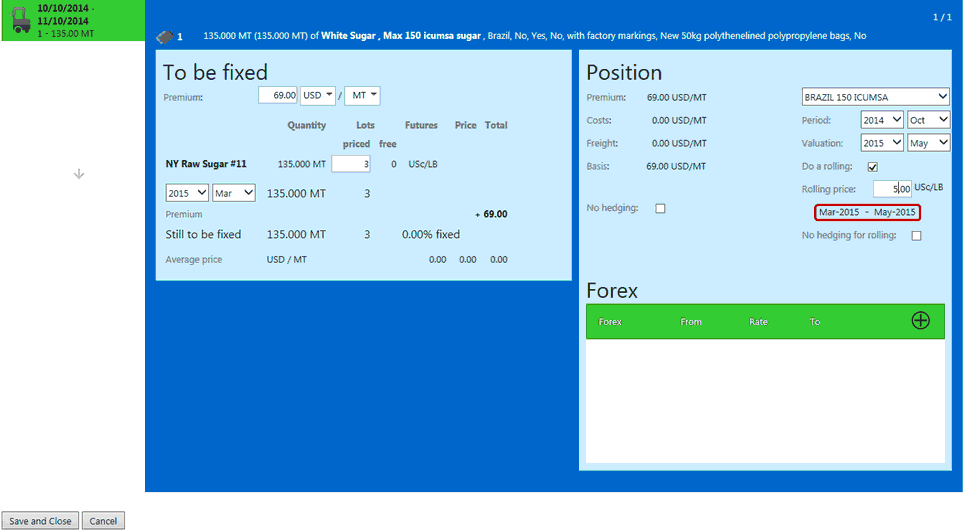

Whether rolling forward from Mar-15 to May-15 or backward from May-15 to Mar-15, the price is always stated in the same way: the Mar-15 price minus the May-15 price. This is what needs to be filled in on the Position Rolling Price field, see screen-shot below of the Risk tab of a contract (Rolling Price is 5 USc/LB and Basis is US$69/MT).

For a Position roll between two periods within the same futures market, the Position Rolling price is the price of the earlier period minus the price of the later period. For example: the price of Aug 2014 minus the price of October 2014.

For a Position roll across future markets, the Position Rolling Price calculation is controlled by the cross-market rank of the future type, as defined in Master data. The Position Rolling Price is the price of the Future market with higher rank (lower number) minus the price of the one with the lower rank (higher number). For example, price of Future market of Cross-market Rank 1 minus price of Future market of Cross-market Rank 2.

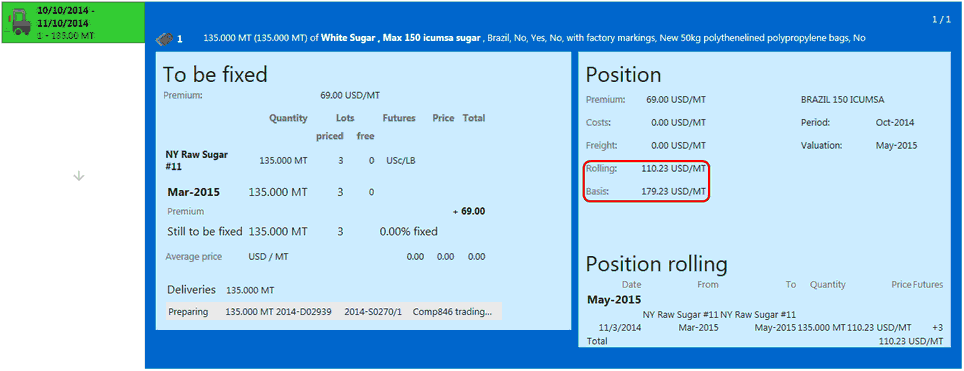

Rolling costs are added as Rolling Direction * Rolling Price to the Basis calculation for both purchase and sales. In the example below, the Rolling Price is 5 USc/LB and old Basis is USD69/MT. Select Save and Close to see the Rolling Price updated:

| • | Old Basis + Rolling Direction * Rolling Price = New Basis. |

| • | This formula includes a conversion factor for USc/LB to USD/MT. |

| • | The new Rolling price of 110.23 USD/MT is added to the old Basis of 69US$/MT to get the new basis of 179.23 USD/MT. |