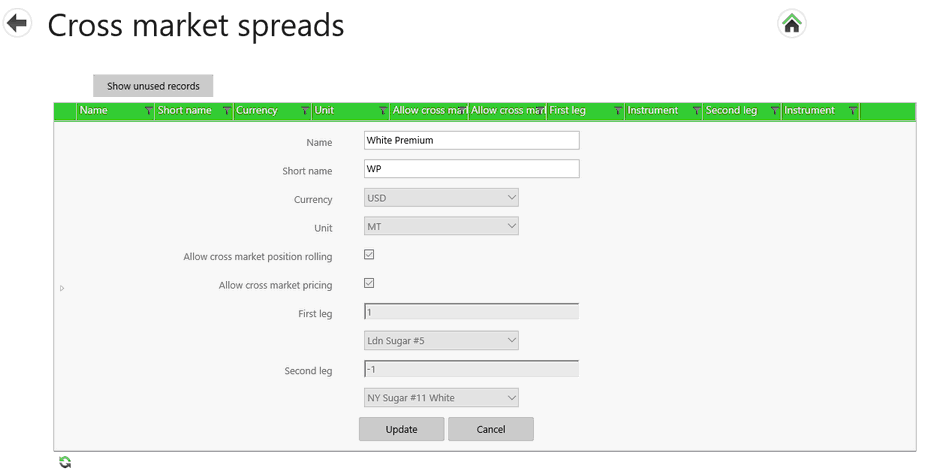

The purpose of a cross market spread record is to give it the cross market activity a name and link it with 2 future markets.

The two futures types used are called legs:

o Each leg is a futures type.

o For each leg Agiblocks defines periods that have a name and that link 2 future periods (1 from each future leg).

o The difference between a left leg and right leg is used to define in which direction the price is calculated: the price of the left leg minus the price of the right leg.

A record also indicates currency & unit measurement.

An Agiboo Consultant will create and configure a cross market spread record. You must have administrative rights to modify Master data may view this record. Editing of the Name and Short name is also allowed. Any other changes will need to be made by an Agiboo consultant or Agiboo Support.

A White Premium configuration will look as follows: