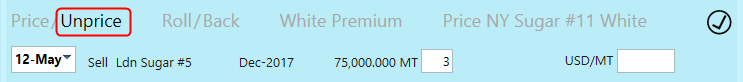

Unpricing is a feature on the pricing dialog on the risk tab of To-be-fixed contracts. When you have previously agreed with your counterparty to price some lots against a market price, this new feature allows you to un-price them against the current market price.

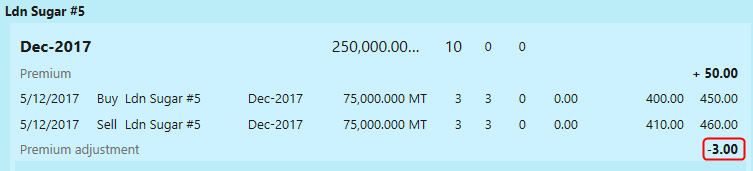

As the unpricing is done against a different market price than the pricing, the result of the unpricing will be included in the calculation of the price. The individual impact of each unpricing will be displayed as a premium adjustment - the result over the unpricing distributed over the entire pricing.

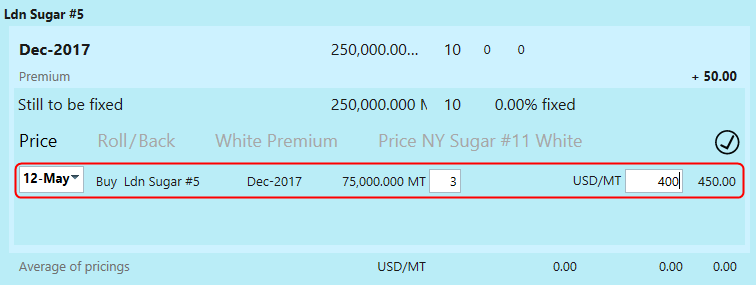

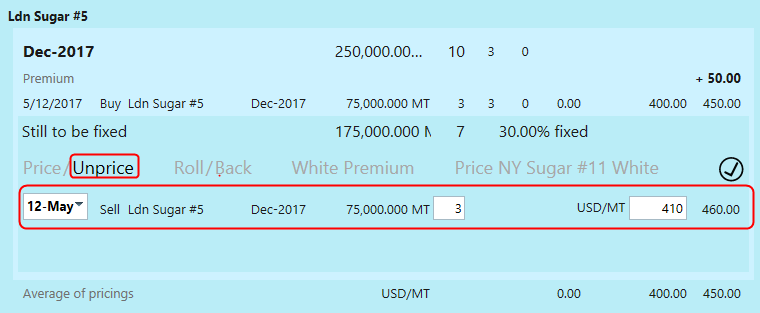

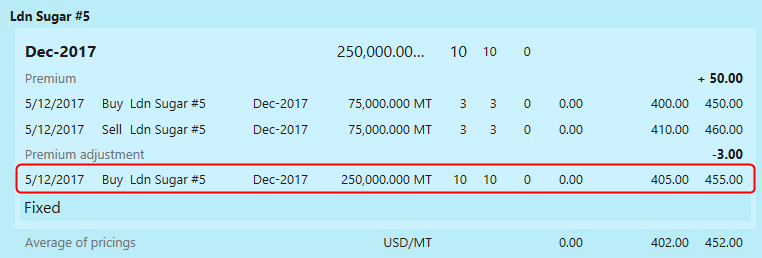

Simple example:

You have a To be fixed sales contract with 10 lots + a premium of 50.

| • | you price 3 lots by buying them for 400 + 50 = 450 |

| • | you un-price all 3 by selling them for 410 + 50 = 460 |

| o | The individual effect of unpricing result = 3 x (400 – 410) / 10 = -3 |

| • | next you price all 10 lots for 405 + 50 = 455 |

Your overall price will be (3 x 400 – 3 x 410 + 10 x 405)/10 + 50 = 452 (Which can also be seen as the 455 from the last pricing plus the premium adjustment of -3)

Note: For systems using Period Closure, unpricing can only be done on Full priced contracts when the full pricing has been done in the current period. If the full pricing was done in a previous, closed period, Period Closure will need to be turned off to unprice these contracts.