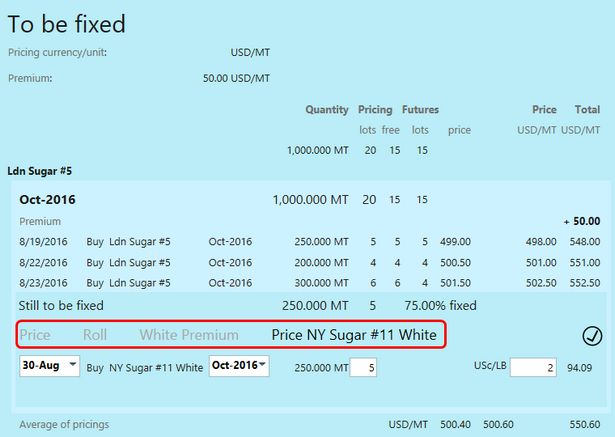

If cross market pricing has been configured, additional tabs will appear in the price edit box. The example below uses a White Premium configuration between Sugar #5 and NY Sugar #11. In it, Agiblocks shows the following tabs:

| 1. | Price: to price against Sugar #5 (the default pricing instrument) |

| 2. | Roll: to roll pricing periods within Sugar #5, either forward or backward |

| 3. | White Premium: to price the White Premium in order to roll the pricing instrument from Sugar #5 to NY Sugar #11. (The White Premium is fixed and will be added to the original premium.) |

| 4. | Price NY Sugar #11 White: it is also possible to fix the target rolling instrument first (e.g. NY Sugar #11 White); White Premium will then will become fixed. |

Effectively pricing the White Premium rolls the remaining pricing to NY Sugar #11 and vice versa - pricing the NY Sugar #11 rolls the remaining pricing to White Premium.

When pricing a White Premium you need to enter:

| • | The trade date (by default today, though the system allows selecting a few days back) |

| • | Which period in the NY Sugar #11 is used (by default the nearest period) |

| • | How many lots are involved (by default all lots that are still to be fixed) |

| • | The agreed White Premium price (no default value) |

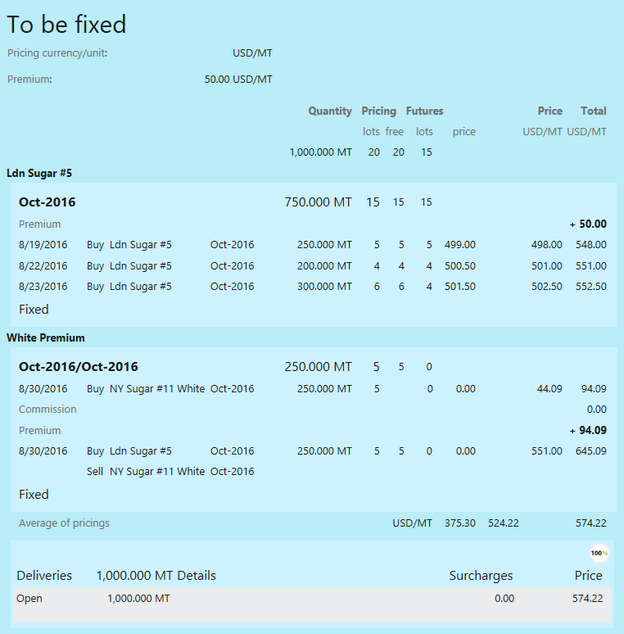

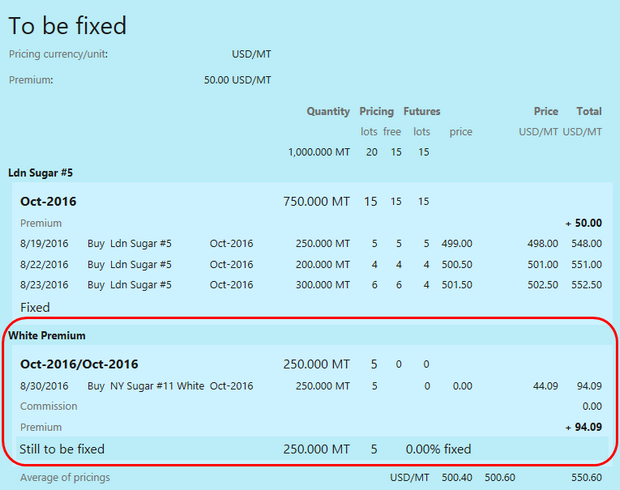

After applying the NY Sugar #11 pricing the screen will end up like this:

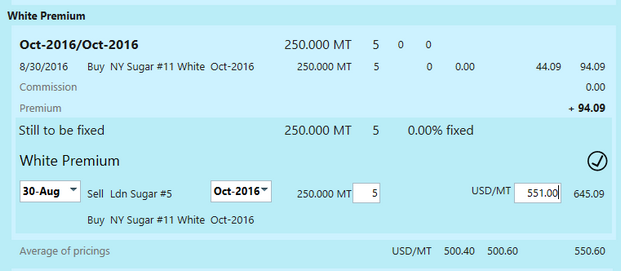

Selecting the Still to be fixed line will bring up the White Premium entry dialog:

Once the White Premium part is priced (in a similar fashion) the subset becomes completely fixed: