By default, the pricing currency of contract line to be fixed, is the currency of the futures market. Traders can select another pricing currency when entering the contract line.

It can also be selected later on the risk tab, per contract delivery line.

Once you have a pricing or rolling on a contract delivery line, its pricing currency can no longer be changed.

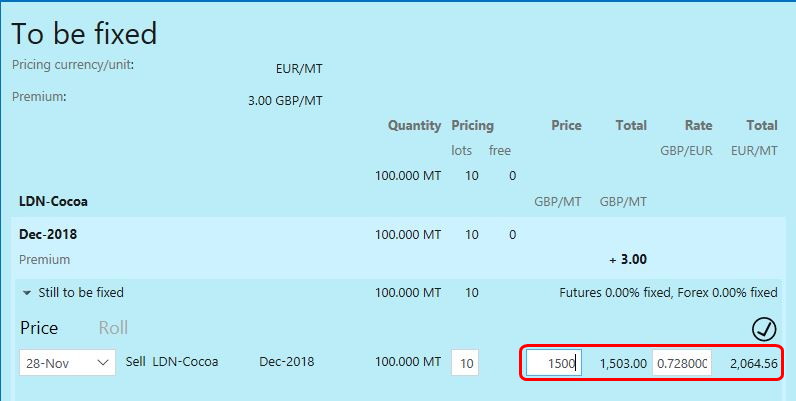

To enter a manual pricing for contracts with a deviating pricing currency, you can follow the same steps as usual when entering a pricing on the risk tab. The only difference is that there will be an extra field to enter the currency rate agreed with the counterparty for this particular pricing. The latest market rate entered into the system is provided as a default value.

While entering the futures price and the rate, Agiblocks calculates the price by adding the premium to the futures price as usual, and then uses the currency rate to convert to the pricing currency.

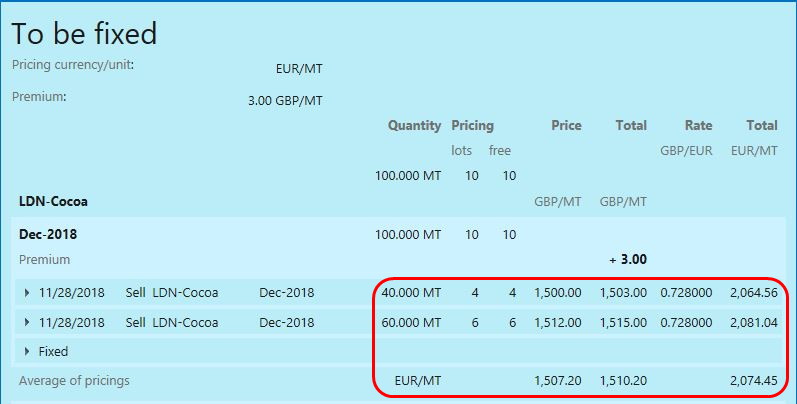

After applying the pricing, you will be able to see the futures price, the price with premium, the currency rate, and the converted price in the pricing table for each individual pricing.

The final price will be calculated as usual as the weighted average of all pricings. But the calculation is made with the amounts in the pricing currency, rather than in the currency of the futures market.

It is also possible to first fix only the futures price and later come back to fix the currency rate. To leave the currency rate open, clear the default rate before saving the pricing. To enter it later you can select the pricing to open the editor. As the pricing is then incomplete, it will not yet be included in averaging calculations. For calculations that can only be made once the rate is entered, the value will be shown as “…”.