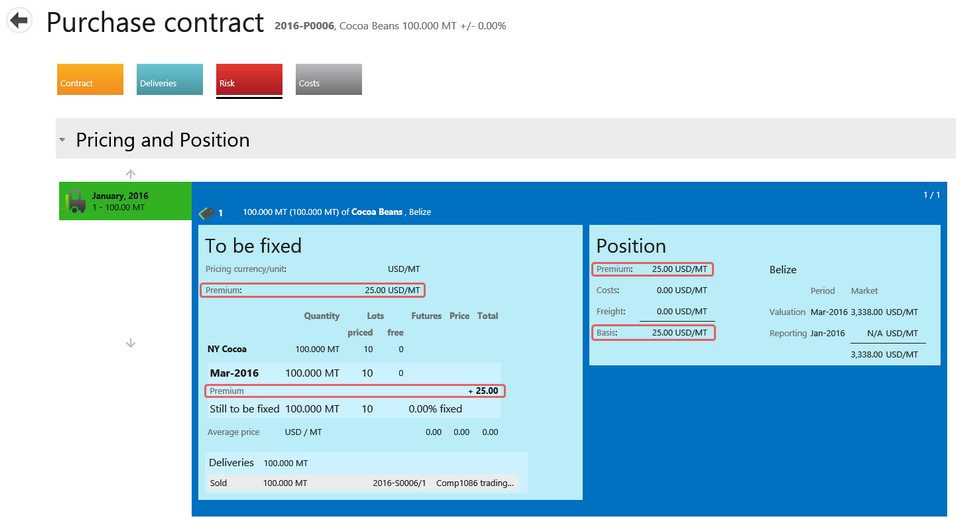

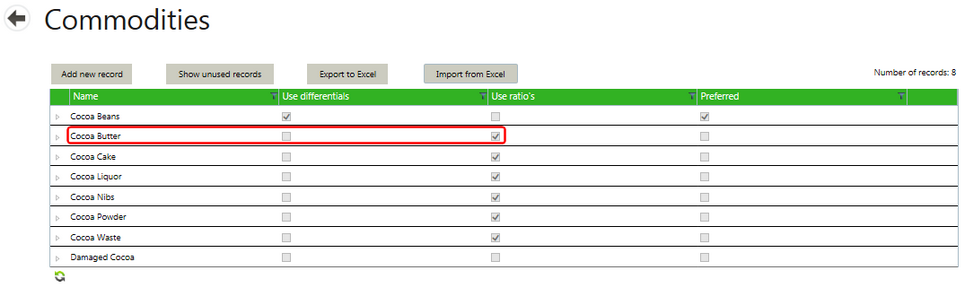

Under the Risk tab of a contract, the difference can be seen between Premiums and Ratios. For commodities with futures like Cocoa Beans, “To be fixed” contracts are priced using a premium on top of a basis:

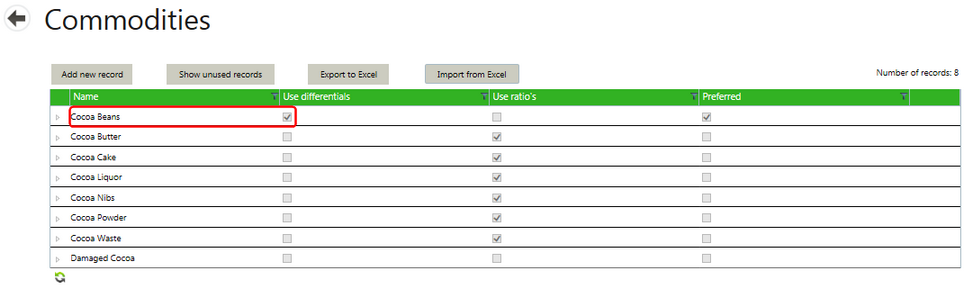

| • | The Premium field is only shown when the commodity has "Use differential" checked under Commodities Master data. |

| • | When the Premium field is not used, Agiblocks chooses a default value of 0. |

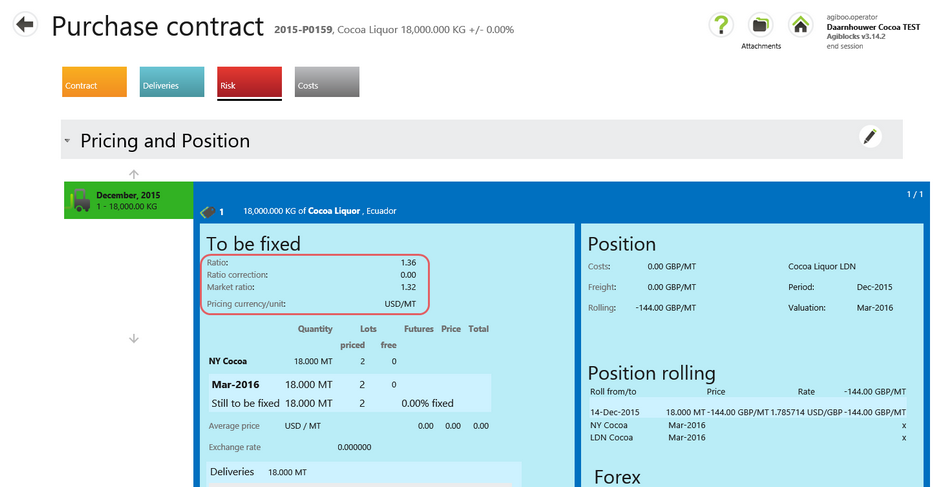

For commodities without their own futures, specifically Cocoa Butter and other cocoa products, “To be fixed” contracts are priced using an agreed ratio to Cocoa Beans futures, a ratio correction and a market ratio:

| • | A Ratio field is shown that allows decimal values greater than zero with 4 decimal places. The default is empty and it is required when ratios are used. |

| • | Along with the Ratio field, a field called Ratio correction is also shown. This field is 0 by default and allows values between -1 and +1 with 4 decimals. In a future release, this field will be used as a contract-specific (per delivery line) correction of the market ratio. |

| • | Both the Ratio and the Ratio correction per contract delivery line are (just like the premium) stored in all the delivery lines created for this contract delivery line. |

| • | On subsequent contract delivery lines, the values from the first line are used as the default values. |

| • | Contract ratio is used for pricing. |

| • | Market ratio is used to calculate hedging. |

| • | The quantity field can be edited to manually change the number of lots from the suggested amount calculated on lot size from the future instrument. Rounding is applied to the lots number as "away from zero" so that 1.5 = 2 and 1.4 = 1. |

| • | If the market ratio changes between two partial pricings of the contract, the total number of lots to hedge is automatically updated. |

| • | Average price is based on Quantity when working with Ratios, whereas it is based on lots when working with a Premium. |

Note: Agiblocks does not make Fixing requirements for Ratio contracts by design. You cannot specify in advance on a ratio contract the number of lots to be used for price fixing. This is because the market ratio's can change, so the number of lots related to a quantity can also change.

Ratio contracts can only be fixed by creating pricings for (partial) quantities on the risk tab, where you can then enter the number of lots used for that quantity. Agiblocks will then create a Hedging requirement for that priced quantity to which futures can be allocated.

| • | The Ratio fields are only shown when the commodity has "Use ratios" checked under Commodities Master data. |

| • | When ratios are not used, the server chooses a default value of 1. |

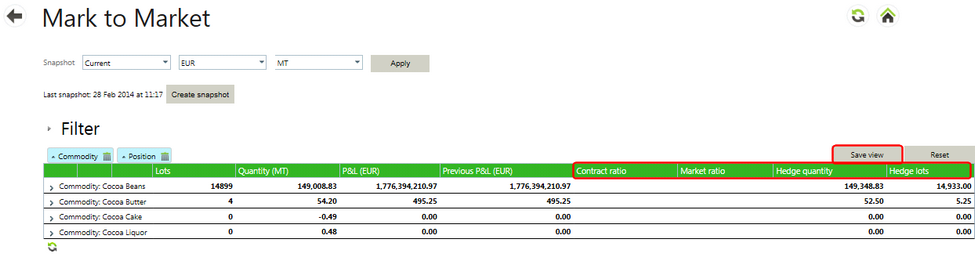

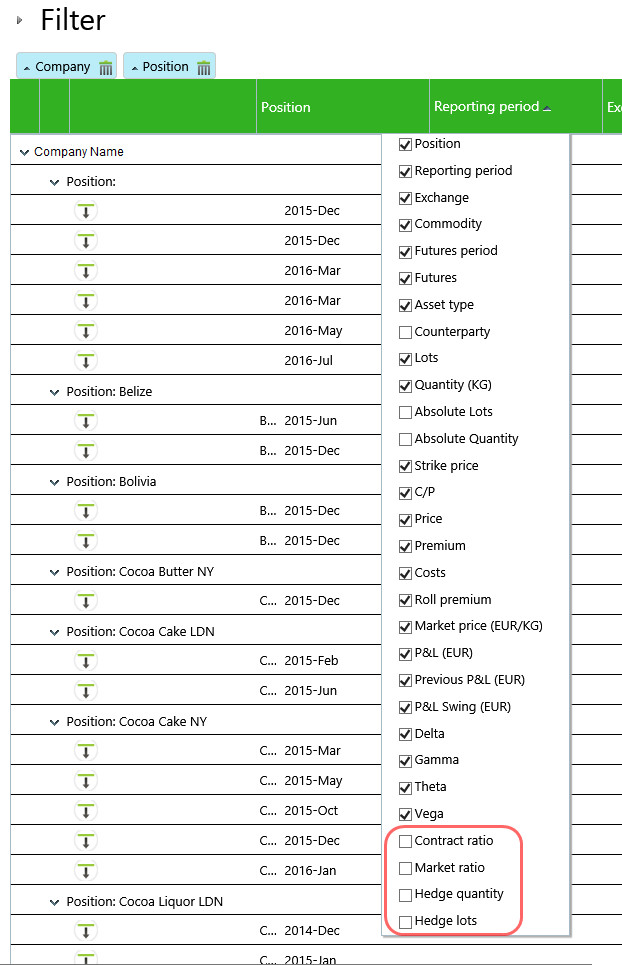

| • | Market ratio appears in the Mark to Market and Position screens to display the risk involved in the quantity vs hedged quantity. |

| • | To make these columns visible, right click-on the green header and select the columns from the bottom of the View Column list. Select Save view to see changes. |

| • | Select the Save View button top right of the table to view these columns and save personal view preferences. |

| • | This is also where you can sort and drag to add column groupings to above the green header or change the order of columns. |