Agiblocks 3.31.13 release fulfills some customer support requests.

Manual Price Calculation for a Time Spread

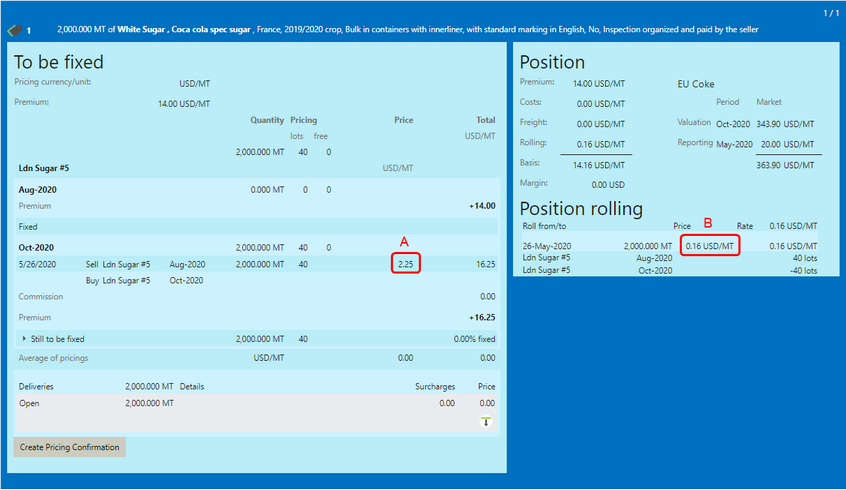

The following is a clarification about price calculations when price rollings are done.

There are 2 prices shown on risk tab. The one on the left one is the price of spread (A) (price rolling). The one on the right is the adjusted price of spread (B) (position rolling). This price on the right is to be applied to contract’s basis.

The adjusted price is either the same as the price if rolling forward, or inverted, if rolling backward. Both the Hedge allocation screen and Risk tab should show the same ACTUAL price of spread.

Thus the rule for calculating the Price of spread is as follows:

| 1. | If there is a position rolling between the same Future instruments then: |

| a. | Price = Price of earlier - Price of later |

| b. | For example Price (May 2020) - Price (Aug 2020) |

| 2. | If there is a position rolling between different Future instruments then: |

| a. | Price = Price (lower market rank) - Price (higher market rank). |

| b. | For example Price = Price (white sugar | rank = 1) - Price (raw sugar | rank = 2). |

Other Changes

| • | The OData interface now supports queries made in a web browser. |

| • | Quantity Units Master Data may now be modified to support both upper and lower case letters for initial entry and editing. |

| • | Postal addresses may now be imported for a Counterparty record. |

| • | Import and Export functions have been added to the Certification Master Data Screen. |

| • | Changing a copied contract quantity now automatically updates the number of lots on the Risk tab. |