|

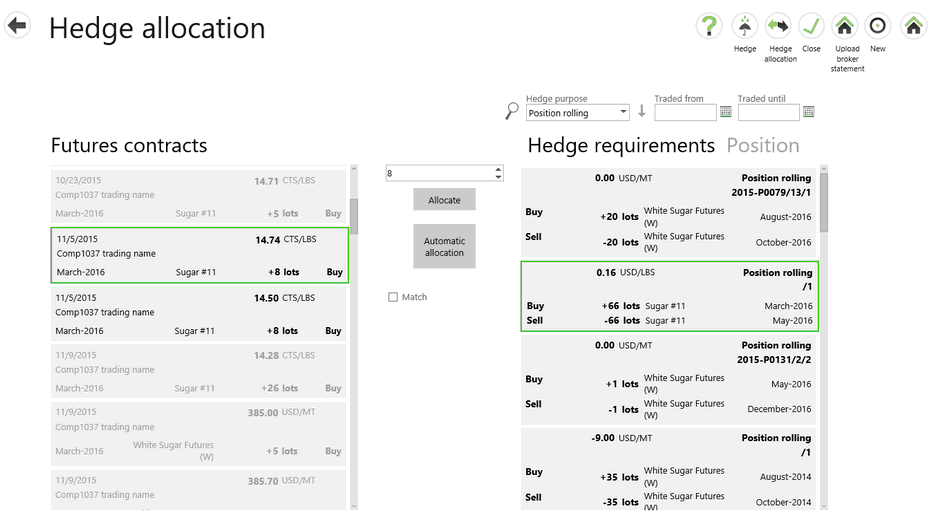

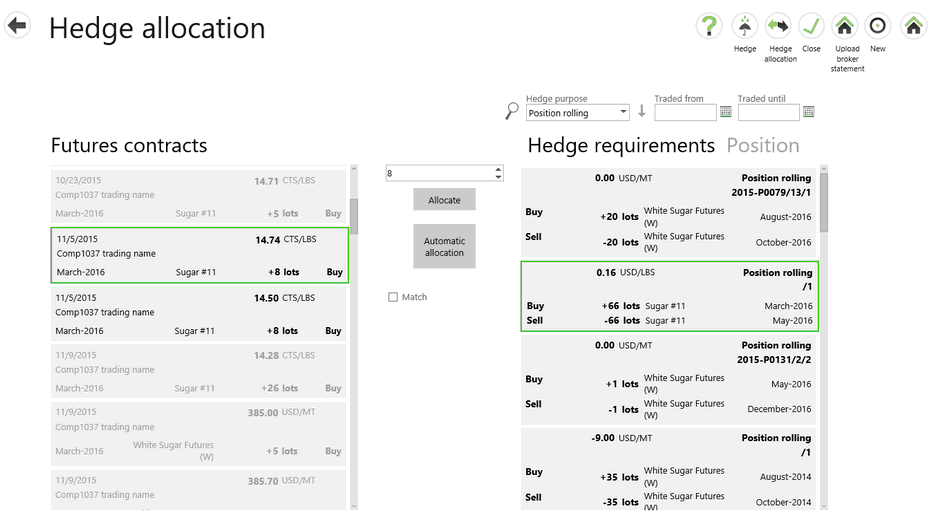

You can allocate futures to position rolling requirements. This can also be done when rolling across future types.

| • | The Hedge allocation screen displays future types with their period if a rolling is done across future markets. |

| • | Rolled futures for positions can be allocated. |

| • | On allocation, the price difference is converted into the pricing currency and pricing unit of the delivery line. This may be in different units: |

| o | For example, rolling Sugar from London #5 to New York #11 means trading one future in USD/MT and the other in USc/LBS. |

| o | Once a contract is rolled to a different market, a new lot will be calculated based on the new market. |

| ▪ | The best example of this would be a contract where the valuation was done on the London Market in the beginning but a user rolled it to a New York Market. 100 lots were rolled from London to New York. Later a user rolled the contract back from New York to London, so Agiblocks rolled only 98 lots based on the New York market. To roll 100 lots again, the user had to increase the quantity by roll an exact 100 lots. |

|