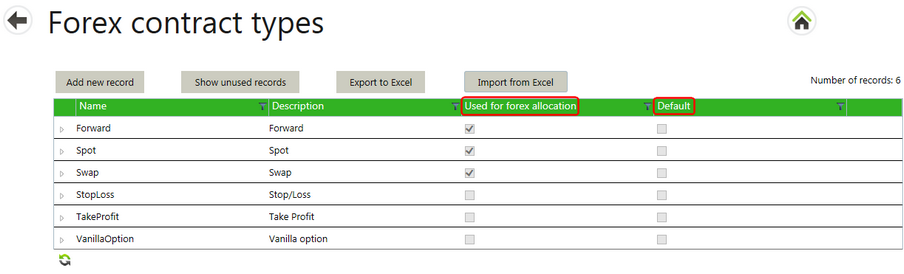

A Master data tile called Forex contract types can be found under the Risk tab of the Configuration screen. An administrator can add new Forex contract types, specify the default Forex contract type to be shown in the drop down list in contracts as well as specify which Forex types should be used for Forex Allocation.

An initial set of Forex contract types have been defined:

Forward |

Hedging by booking an exchange rate up to a year in advance. |

Spot |

Buy or sell for immediate delivery. |

Swap |

Forex that is meant to buy/sell back an existing Forex and sell/buy on a new maturity date. |

Stop/ Loss |

A minimum rate at which the currency will be bought or sold. |

Take Profit |

A limit order which sets a maximum rate at which currency will be exchanged. |

Vanilla Option |

Standardized terms which gives the right but not the obligation to buy or sell currency at a predetermined price (strike rate) within a given time frame. |

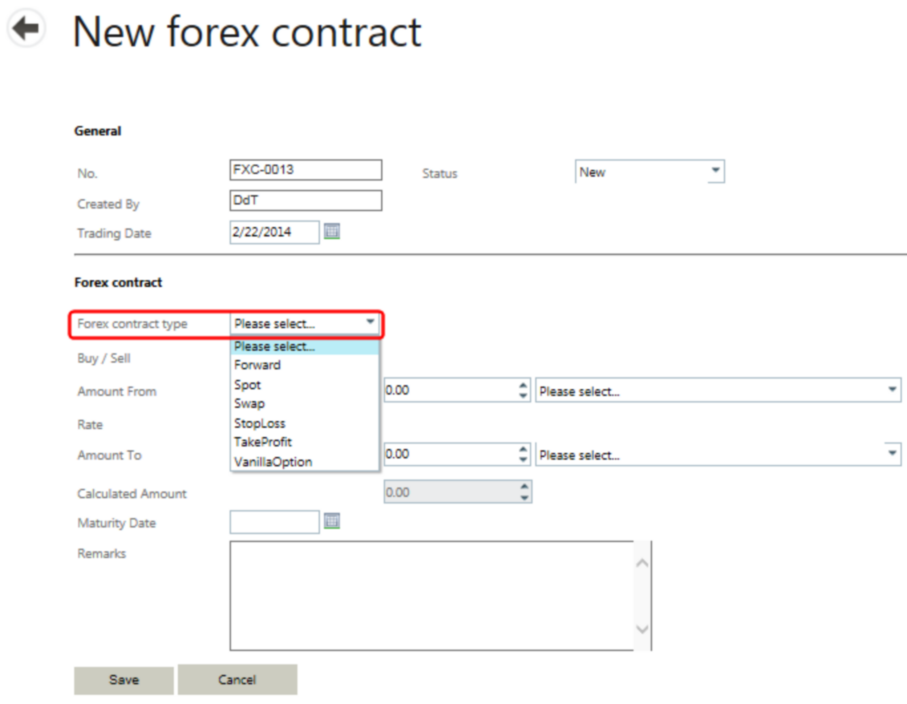

You can select the relevant Forex contract type from a drop-down box when entering a new Forex contract.